When you purchase a new item for your business you may be given a ticket as proof of payment. This is not valid to offset the expense against your tax. Learn what you should look for in a valid invoice for tax purposes and why this is important.

What should be included.

The content of an invoice is regulated by the EU law dir2006/112/EC art.178 and 2010/45/EU. Therefore, it should be the same for any invoice issued in any of the EU countries.

Missing part the required information will make it invalid to offset the expense, regardless of how legitimate we feel it is.

Lately, incomplete invoices do not stand before an inspection and are removed from the ledger.

We consider here what you generally need to look for in an invoice to be included in your expenses.

For a consideration of how to prepare the invoices that you need to issue to your clients read our post “What to include on an invoice”.

In general, an invoice must contain what is listed bellow.

1) The word ‘Invoice’ ( in any language) should be clearly visible.

2) Tax ID of issuer.

This includes: Name, Vat number ( In Spain, this is the same as the CIF for limited companies or NIE for self-employed individuals*) and address.

3) Tax ID of receptor.

This is your tax ID; name, NIE and Address. This is vital to relate the expense to you. Without this, you will not be able to offset the expense. In some cases, additional information is needed though. For a detailed discussion check our post: Expenses Difficult to Justify.

4) Detailed description of the services/items invoiced.

5) Total of Services before tax

6) Detailed breakdown of VAT; stating the VAT rate and the resulting tax amount.

7) Total of Invoice.

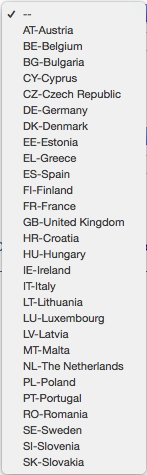

* NIF/ VAT NUMBER. : When invoices are issued to/received from other EU Country it should display the International format of the number, including the country suffix. ( in Spain, ES)

Limit Consulting

Limit Consulting