Some times your clients give you a deposit in order to buy items or pay for services in his behalf.How should you include these in your invoices? In what cases do you have to include it as an income?

Of course you want your invoice to reflect the deposit that you have taken to that end, but in a way that does not increase your incomes as it was not part of your charges to your client: You simply take funds from your clients to make some purchases in their behalf.

Let us consider some cases.

Case 1.

The invoices for those items are issued in your client’s name, not yours.

You need these invoices merely to show that you spent the deposit given and to justify the costs.

In this case, those invoices are not your expenses. Certainly you have not paid for them but your client did. They are in someone else’s name and you cannot include them in your books.

However, you may want to keep record of the money being taken. (it could be that you received it through a bank transfer along with your charges).

Your invoice should look like this:

| Client’s ID and Tax Number | |

| my charges | 100 € |

| IVA | 21 € |

| TOTAL Invoice | 121 € |

| Other purchases | 500 €* |

| Total | 621 € |

This is one of many possible ways. The key is to separate the 500€. Once we have the invoices of our purchase we should keep copies along with the invoice. This will serve to justify in a Tax investigation that though we received those funds it was not part of our income.

(*)There is no need to put the breakdown of the IVA in the deposit amount as it will be shown in the respective invoices. This line is just an acknowledgement of having received the funds.

How to do it in Quipu

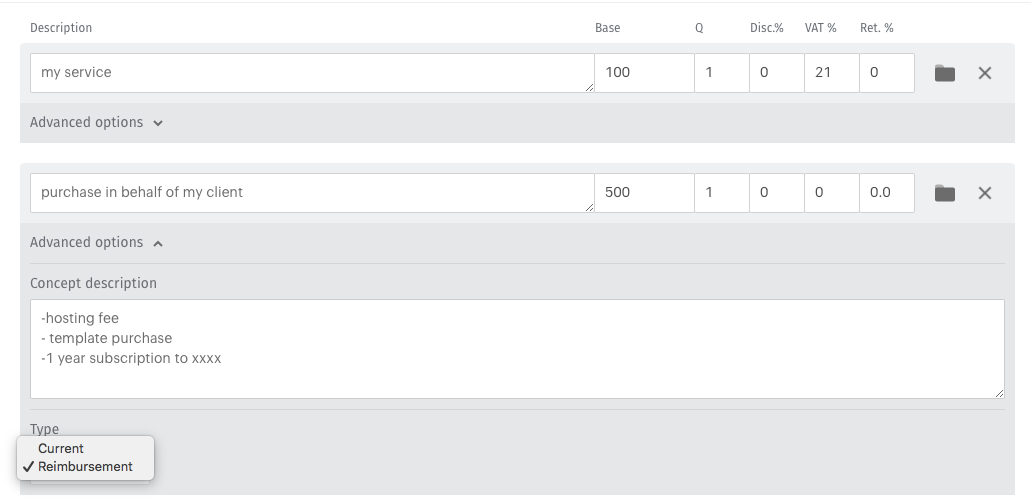

We introducing the new line for the expenses mark “Reimbursement” within Advanced options. (see picture).

Case 2.

The invoices for those items or services are issued to your name.

This might be because you buy them using your own account with the service provider in order to benefit from your discount with them, that later you may want to pass on to your client or may not.

Now the invoices for the purchases are in your own name. They can be included in your expenses. But the counterpart must be too; the invoice that you issue to your client must contain the charge for the services or material too.

if your Purchase looked like this:

| my own ID and Tax Number | |

| item | 300 € |

| my discount | -50 € |

| total before tax | 250 € |

| IVA | 52.50 € |

| Total | 302.50 € |

Then your invoice may look like this:

| Client’s ID and Tax Number | |

| my charges | 100 € |

| materials | 300 € |

| total before tax | 400 € |

| IVA | 84 € |

| Total | 484 € |

Notice that should you not include the resale of the external services/items to your client as an income then the accounts would be unbalanced; you would be claiming illegitimate expenses that would be easily tracked in an inspection. To illustrate, a carpenter charges 600€ for assembling an IKEA kitchen ( which obviously the client paid), but he gets the invoice from IKEA in his name an he offsets 4000€ expenses associated to that one job!.

How to do it in Quipu

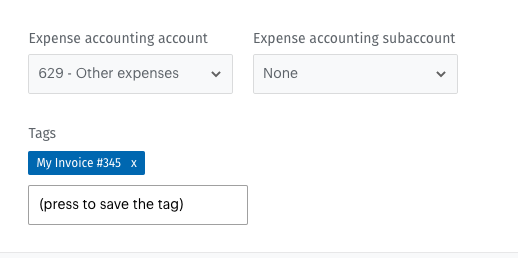

Simply account for the two invoices as shown above; one for the income and other for the expense. Use the Tags field if you need to associate the expense to the income.

- You can use the search field to find a particular Tag.

- Tags are also visible when exporting the data into Excel.

Limit Consulting

Limit Consulting