Learn the basics of income tax in Spain. What types of income are included? Tax rates. Allowances. Are you liable?

Anyone resident in Spain who received income of any kind in 2023 is obliged to file a tax return or RENTA, with a few exceptions.

Related: Exemption from Income Tax declaration.

Different types of incomes.

The annual tax return includes all income of any kind that we can divide into the following categories:

1. Employment related income: Wages, salaries, pensions, other compensation in kind.

2. Income from Real Estate.

3. Income from Assets other than Real Estate.

4. Income from Business Activities.

5.Accrued income (this is a type of wealth tax).

6. Capital gains

The income of these categories may be taxed at the regular rate or at the savings rate, depending on whether the period of time during which the income was earned was less or more than 2 years.

Double taxation agreements.

If the income was earned in another country, it must also be declared in Spain. If there is a double taxation treaty between Spain and the other country (this includes all EU countries and some others), any tax paid on this concept abroad will be deducted from your tax liability in Spain.

Example 1

You receive a state pension in your own country for which you have to pay tax of €1100. When declaring this income in Spain, you will also declare the tax payment made abroad, which in turn will reduce the tax liability.

Example 2.

Renting a property in your home country gives you income on which you must pay tax in your home country. You will still be required to declare the income, but the tax paid will reduce your tax liability here in Spain.

General Tax Scale and Tax Scale for Savings.

Tax collection powers in Spain are shared between the central and regional governments.

Different regions have their own tax scales, albeit with little variation, which supplement the central estate tax rates. You can find a good approximation here.

Table 1. Tax Scale for General Incomes

IRPF (Personal Income Tax) General Scale in 2023

| Taxable Base (up to) | Tax | Rest ( up to) | Tax Rate |

|---|---|---|---|

| 0,00 € | 0 | 12450 € | 19% |

| 12,450 € | 2365.50€ | 7,750€ € | 24% |

| 20,200 € | 4225.50€ | 15,000€ | 30% |

| 35,200 € | 8725.50€ | 24,800 € | 37% |

| 60,000 € | 17901.50€ | 240,000 € | 45% |

| 300,000€ | 125,901.50€ | 49% |

Learn how the tables work in this article.

Table 2. Tax Scale for Savings

IRPF (Personal Income Tax) Savings Scale in 2023

| Taxable Base (up to) | Tax | Rest ( up to) | Tax Rate |

|---|---|---|---|

| 0,00 € | 0 | 6000.00 € | 19% |

| 6000 € | 1140€ | 44,000.00 € | 21% |

| 50,000€ | 10380€ | 150,000€ | 23% |

| 200,000€ | 44880€ | 100,000€ | 27% |

| 300,000€ | 71880€ | 28% |

Paperwork and documented proofs.

When filing your tax return, you do not need to attach any documents to prove your income, but it is advisable to keep them together in a folder in case of an audit. You will then only have a short time to gather them all together.

Related: What information do you need to prepare your annual tax return?

Allowances

Personal allowances can be claimed at the time of filing your annual tax return. Not all of them have the same effect on the final tax bill. Some reduce the taxable amount and others reduce the actual tax due.

Some of the concepts that bring a tax deduction at the moment are:

Reductions to Taxable Amount due to personal circumstances.

| Tax Free Amount for tax Payer | |

| (according to personal circumstances) | |

| General | € 5,550.00 |

| 65+ | € 6,700.00 |

| 75+ | € 8100.00 |

| Amount per descendant | |

| First | € 2400.00 |

| Second | € 2,700.00 |

| Third | € 4000.00 |

| Fourth + | € 4,500.00 |

| Any child under 3 will increase the amounts | € 2,800.00 |

| Amount per ascendant | |

| disable or 65+ | € 1150.00 |

| 75+ | € 2,550.00 |

Any contribution to a private pension plan (with some limits)

Contributions to pension plan of a disable family member.

Tax compensation for Maternity

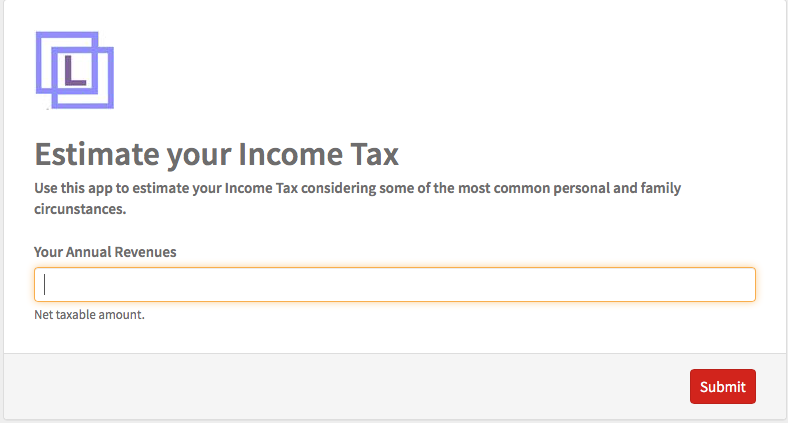

Use our Web App: Estimate your Income Tax to get an approximation of your tax liability under the most common family and personal circumstances, with incomes belonging to the General Tax Scale.

Final Figure. Payment or Rebate?

If you are a self-employed person, you have probably made quarterly advance payments against your final tax liability.

This is when, after all your income and allowances have been taken into account, your final tax liability is determined and, if you have overpaid, you will be pleasantly surprised with a tax refund.

Of course, it could also be that you need to pay more. This happens when your personal tax rate applicable exceed the 20% default rate that is applied to retentions and advance payment.

Limit Consulting

Limit Consulting