The IVA book is a document where all your economic activity is defined. One by one the invoices issued and received, all transactions subject to IVA.

There must be a number, date of issue and completion, name, company name or full name and tax identification number of recipient, the tax base of operations, the tax rate and the amount of tax.

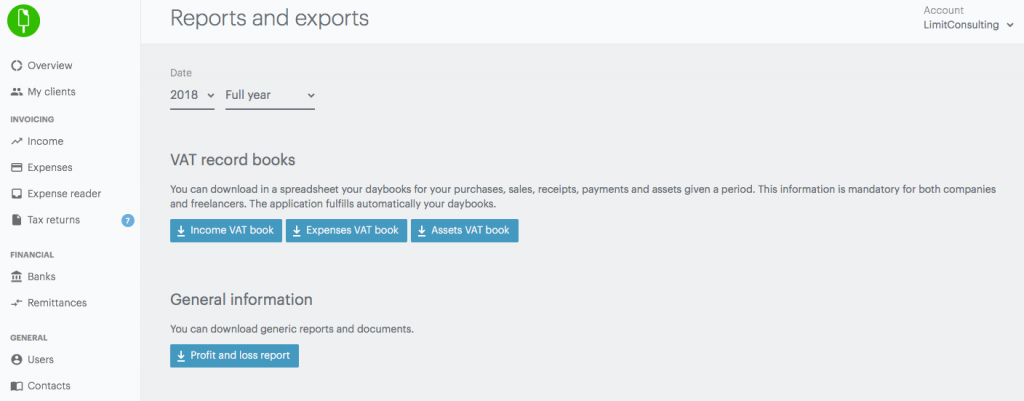

In Quipu, once you’ve uploaded ALL information, you can obtain your IVA books in EXCEL format by clicking on Reports and exports, in the Overview screen.

Limit Consulting

Limit Consulting