As a Spain based business our accounts should be exclusively in Euros. For this when we receive invoices in other currency we need to convert it to euros.

The conversion rate to be applied to the amount is that of the date in which the invoice was issued.

Once you know the value in Euros then :

1. upload the document to Quipu normally

2. manually input the amounts in Euros.

Matching the payment with the invoice

If the invoice was not paid on the same day as it was issued, assuming we paid it from a euro account, we will most likely have paid a different amount in euros to the exchange value on the day of the invoice.

This is because exchange rates change all the time and, for example, $100 is not the same amount of euros on one day as it is on another.

If you trade as an Autonomo, this difference does not affect you, at least from an accounting point of view. Autonomos do not have to keep a register of bank accounts and reconciling invoices with actual payments is not very important. They simply mark the invoice as paid, even if the amount paid differs slightly from the total amount of the invoice.

However, if you are trading as an SL company, more detailed accounting is required. In this case, the difference must be accounted for in the exchange.

For that do the following:

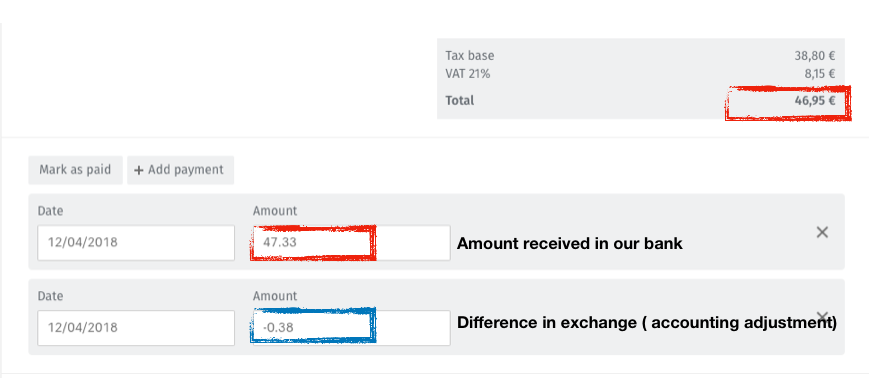

1. Add a payment to the invoice for the amount actually paid from your bank.

2. Then click on mark as paid. Quipu will add other payment with the difference , positive or negative, to complete to the total.

3. Add a tag “ difference in exchange” so that we can spot them easily in order to finalize some accounting adjustments.

See result:

Limit Consulting

Limit Consulting