As a Spain based business our accounts should be exclusively in Euros. For this when we receive invoices in other currency we need to convert it to euros.

The conversion rate to be applied to the amount is that of the date in which the invoice was issued.

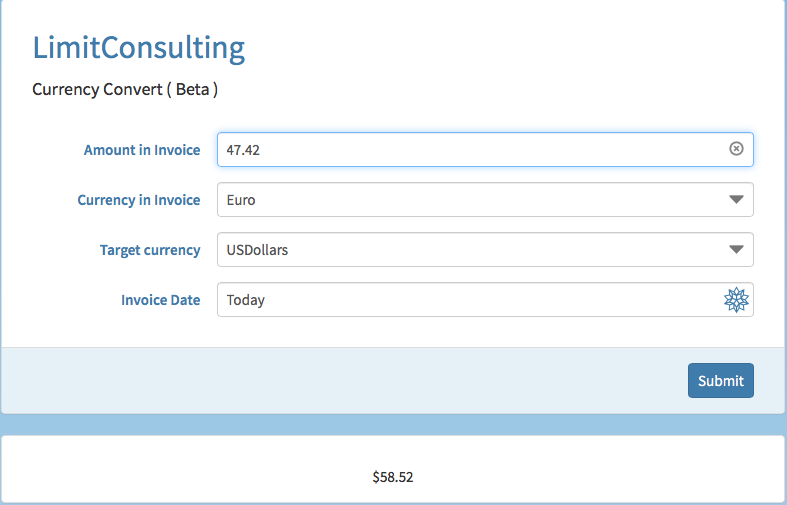

To find out the value in euros of an invoice introduce amount, currency and date in the following currency converter.

Once you know the value in Euros then :

1. upload the document to Quipu normally

2. manually input the amounts in Euros.

Matching the payment with the invoice

If the invoice was not paid on the same day as it was issued, assuming that we paid it from an euro account, most likely we will have paid a different amount in euros that the conversion value on the day of the invoice.

This is because currency exchange rates change all the time and $100, for example, is not the same amount of euros one day than another.

If you are trading as autonomo you do not be concerned by this difference, form the accounting point of view at least. Autonomos do not need to show registry for the bank accounts and the matching of the invoices with the actual payment is not very important. You will simply mark as paid the invoice even if the amount paid varied slightly with the total of the invoice.

However, if you are trading as a SL company a more detailed accounting is required. In this case it needs to be accounted for the difference in the exchange.

For that do the following:

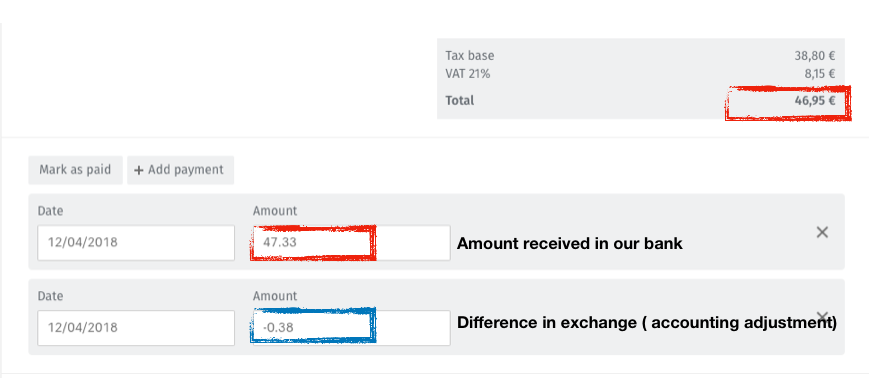

1. Add a payment to the invoice for the amount actually paid from your bank.

2. Then click on mark as paid. Quipu will add other payment with the difference , positive or negative, to complete to the total.

3. Add a tag “ difference in exchange” so that we can spot them easily in order to finalize some accounting adjustments.

See result:

Limit Consulting

Limit Consulting