Where do you see in Quipu how much IVA or Income Tax you are going to pay at the end of the quarter?

We are going to explain here how you can estimate your quarterly results by having a quick look to Quipu’s dashboard.

It might be helpful to read first our post: IVA, Incomes Tax and Retention.

IVA.

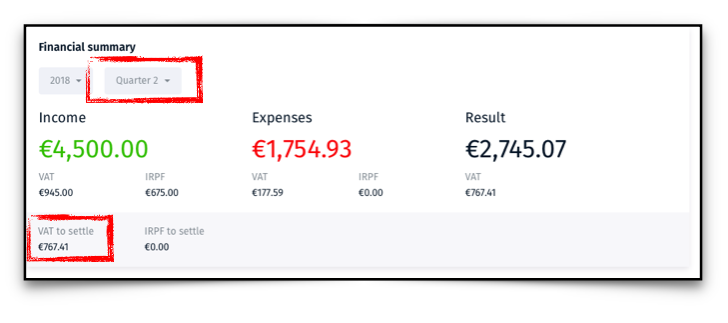

Important: Make sure that the period that you are looking at is the quarter in which you are. ( In our example below, quarter 2)

Tipically your dashboard will look somewhat like this:

The amount of Iva that you will pay is under “ VAT to settle”.

This amount is calculated by subtracting the VAT in your Expenses, and whatever VAT credit we may have, to the VAT in your Incomes.

Income Tax. ( For Self-employed)

This tax is calculated with accumulated amounts of incomes and expenses. This makes it a bit more complicated.

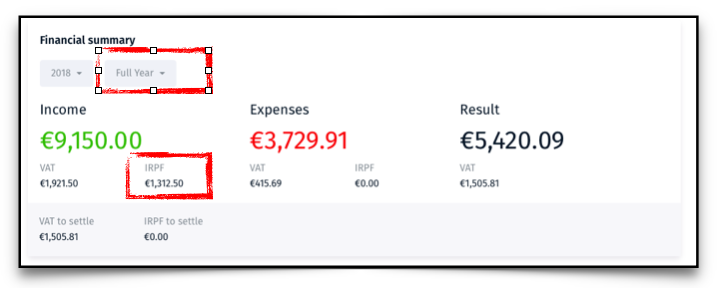

To estimate the tax result make sure that the period that you are looking this time is the full year.

This time your dashboard may look somewhat like this:

Notice that we have highlighted the figure under IRPF, in the Income side.

This is the total of Retentions ( withheld tax ) that you may have included to your invoices.

In the case of most Autonomos this number will be nil.

To know more about retention and what cases you are obliged to include it watch the video Retention.How does it work here.

Once you have clear all elements your estimated tax can be worked out:

Step 1. Work out 20% of Result. In our example: 1084,02€

Step 2. Subtract Retentions ( Tax already paid) : 1084,02 – 1312.50 = -228.48

Step 3. Subtract amount of Income Tax already paid in previous quarters.

If the result is NEGATIVE there is no more tax to pay. Actually you have overpaid tax and, if things remain the same at the end of the year, you will get a tax rebate.

This method is an approximation because there are other allowances that may be applied at the time of tax filing resulting in further reductions.

Quipu is included without additional cost in all our accounting plans.

Limit Consulting

Limit Consulting