It is important to make sure that your Intra-european invoices are properly declared.

Nearly every business which operates online nowadays receives an invoice from Google or Facebook. These companies invoice their customers from their respective branches in Ireland. If you have a business account with these internet companies they will issue intra-community invoices.

What do you need to do with them?

It is very important that we account for them and report them in the right way.

In order to issue or receive an intra-community invoice a business must be registered in the European database of traders and it requires an international VAT number.

When we have the due registration (ROI – Registro de Operadores Intracomunitarios) we can receive invoices without VAT. This article explains how to account for it in Quipu.

Issues arise when we receive one of these invoices without the registration. The other party would have declared their invoice as an international transaction and the Tax Agency will get to know that we have had this transaction. Hacienda will require from us the due report of intracommunity operations. Then the possibility of a fine is almost certain.

What to do then?

If we occasionally receive an invoice without IVA but have no intention of trading within the European market we should request for the VAT to be added. In this way the other party will not report it as an intracommunity transaction.

This might be the case of:

- Someone who needs to make an occasional purchase outside Spain.

- A business that operates locally in Spain but receives invoices from Google for its internet advertising.

In these cases you still can offset the invoice in your accounts as an expense.

If the invoice has foreign IVA in it you will include the total as the base.

For example, a purchase in Ireland , with 23% of VAT, may be like:

Base: 100€

VAT: 23€ .

Total: 123€

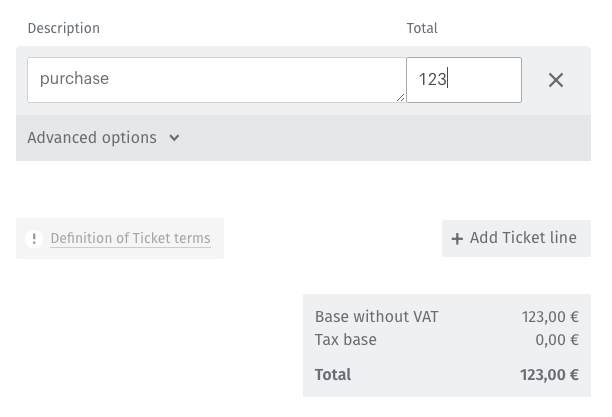

Our accounting of this invoice should be input using the bottom:![]()

Our input would look like the following:

By doing this, Quipu will offset the total off the income tax but nothing off the IVA.

Summarising, it is very important to account for and report our invoices in harmony with our registration in order to not to trigger an unpleasant letter.

Limit Consulting

Limit Consulting