IBI (Impuesto de Bienes Inmuebles) is a local tax, administered by the Town Hall, levying on ownership of a property. It is accrued yearly on the 1st of January.

The obligation to pay this tax is for both residents and non-residents and it does not depend on the use that you give to the property.

The final tax bill is based on the registry value ( valor catastral ) of the property. This is determined by a series of technical reasons; location, ground value, urban or rustic property, etc…

This does not correspond with the market value of the property.

This value is updated every 10 years.

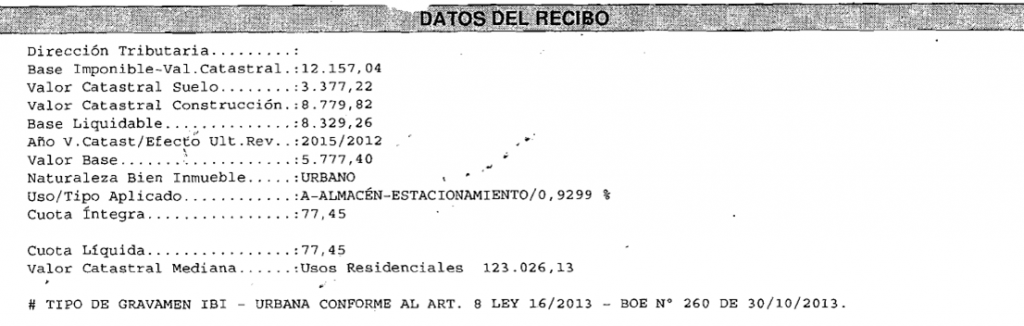

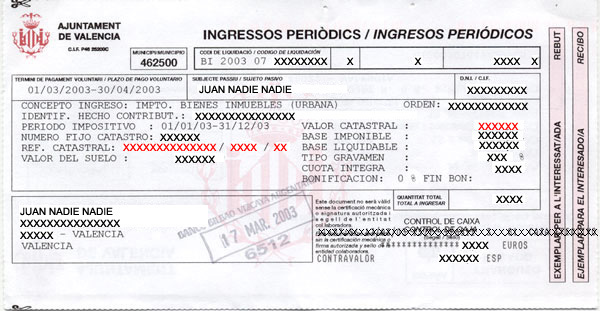

The IBI tax receipt.

Each year the Ayuntamiento posts a IBI tax receipt to every owner. This contains some essential information that it is necessary to prepare other tax.

Registry Value or valor catastral.

Apart from being the reference for the IBI tax itself, this Registry Value serves also for the calculation of the Non-resident Property Tax.

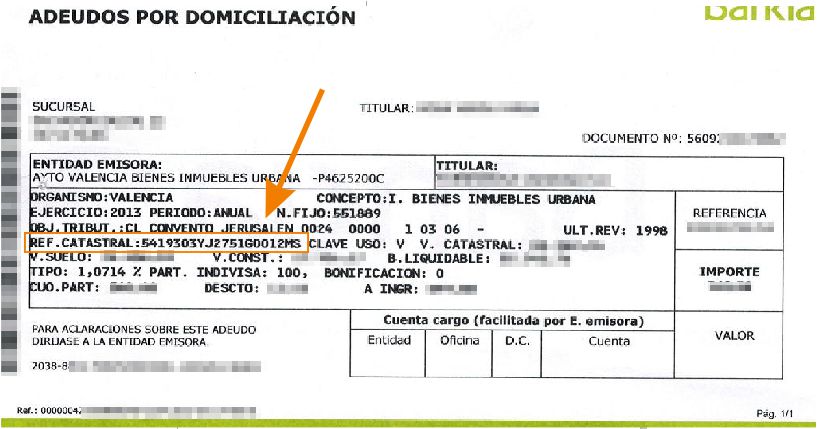

Registry Code or referencia catastral

This is an ID code for the property. This code might also appears in the title deed of the property, but only in resent years.

The code is also necessary to file other tax forms: Non-Resident Property tax again and others.

As this is a local tax, the actual receipt does not have a standard format for all the territories.

If your IBI is paid via standing order to your bank account, the bank receipt may also contains all relevant information.

A search in Google for images of IBI receipt will reveal a variety of formats.

Limit Consulting

Limit Consulting