An important change in the autonomo contribution system takes place starting in January,2023.

Until now, those under “autonomo” contribution system ( sole traders, company’s directors and family members assisting in the business) contribute to the Social Security based on a theoretical salary which is later taken as reference to calculate benefits. The payment to Social Security was not linked to the real income but to one figure chosen by the individual within certain limits: the contribution base.

From 1 January 2023 the contribution system will be based on net business income. In other words, you will pay contributions based on your actual income.

This change will affect the contributions to be paid in 2023; some autonomo with lower earnings will benefit from a reduction in the amount that they pay to the Social Security every month, whereas those with higher incomes will see their contribution increased.

The law has stablished a transition period of 3 years in which the contributions will adjust gradually until they settle in their final figure.

A person earning 12,000€ per year will pay 275€ per month in 2023, 267€ in 2024 and 260€ in 2025.

On the other hand, a person earning 24,000€ per year will pay 330€, 340€ and 415€ in 2022, 2023 and 2024 respectively.

In the following tables you can see the the contribution corresponding to the declared incomes in each year.

For each interval of actual income there is the possibility to choose between the minimum contribution base and a maximum one. This allows for a measure of fine tuning one’s contribution base.

|

|

| 2023 |

|

|

| Earnings | Min Base | Contribution | Max Base | Contribution |

| < 670 | 751,63 | 230 | 849,66 | 260 |

| 670 – 900 | 849,67 | 260 | 900 | 275 |

| 900 – 1166,7 | 898,69 | 275 | 1166,7 | 357 |

| 1166,7 – 1300 | 950,98 | 291 | 1300 | 398 |

| 1300 – 1500 | 960,78 | 294 | 1500 | 459 |

| 1500 – 1700 | 960,78 | 294 | 1700 | 520 |

| 1700 – 1850 | 1013,07 | 310 | 1850 | 566 |

| 1850 – 2030 | 1029,41 | 315 | 2030 | 621 |

| 2030 – 2330 | 1045,75 | 320 | 2330 | 713 |

| 2330 – 2760 | 1078,43 | 330 | 2760 | 845 |

| 2760 – 3190 | 1143,79 | 350 | 3190 | 976 |

| 3190 – 3620 | 1209,15 | 370 | 3620 | 1108 |

| 3620 – 4050 | 1274,51 | 390 | 4050 | 1239 |

| 4050 – 6000 | 1372,55 | 420 | 4139,4 | 1267 |

| 6000+ | 1633,99 | 500 | 4139,4 | 1267 |

|

|

| 2024 |

|

|

| Earnings | Min Base | Contribution | Max Base | Contribution |

| < 670 | 735,29 | 225 | 816,98 | 250 |

| 670 – 900 | 816,99 | 250 | 900 | 275 |

| 900 – 1166,7 | 872,55 | 267 | 1166,7 | 357 |

| 1166,7 – 1300 | 950,98 | 291 | 1300 | 398 |

| 1300 – 1500 | 960,78 | 294 | 1500 | 459 |

| 1500 – 1700 | 960,78 | 294 | 1700 | 520 |

| 1700 – 1850 | 1045,75 | 320 | 1850 | 566 |

| 1850 – 2030 | 1062,09 | 325 | 2030 | 621 |

| 2030 – 2330 | 1078,43 | 330 | 2330 | 713 |

| 2330 – 2760 | 1111,11 | 340 | 2760 | 845 |

| 2760 – 3190 | 1176,47 | 360 | 3190 | 976 |

| 3190 – 3620 | 1241,83 | 380 | 3620 | 1108 |

| 3620 – 4050 | 1307,19 | 400 | 4050 | 1239 |

| 4050 – 6000 | 1454,25 | 445 | 4139,4 | 1267 |

| 6000+ | 1732,03 | 530 | 4139,4 | 1267 |

|

|

| 2025 |

|

|

| Earnings | Min Base | Contribution | Max Base | Contribution |

| < 670 | 653,59 | 200 | 718,94 | 220 |

| 600 – 900 | 718,95 | 220 | 900 | 275 |

| 900 – 1166,7 | 849,67 | 260 | 1166,7 | 357 |

| 1166,7 – 1300 | 950,98 | 291 | 1300 | 398 |

| 1300 – 1500 | 960,78 | 294 | 1500 | 459 |

| 1500 – 1700 | 960,78 | 294 | 1700 | 520 |

| 1700 – 1850 | 1143,79 | 350 | 1850 | 566 |

| 1850 – 2030 | 1209,15 | 370 | 2030 | 621 |

| 2030 – 2330 | 1274,51 | 390 | 2330 | 713 |

| 2330 – 2760 | 1356,21 | 415 | 2760 | 845 |

| 2760 – 3190 | 1437,91 | 440 | 3190 | 976 |

| 3190 – 3620 | 1519,61 | 465 | 3620 | 1108 |

| 3620 – 4050 | 1601,31 | 490 | 4050 | 1239 |

| 4050 – 6000 | 1732,03 | 530 | 4139,4 | 1267 |

| 6000+ | 1928,1 | 590 | 4139,4 | 1267 |

Assuming one always chooses to pay the minimum possible contribution this table boils down the results.:

| Earnings | Contribution in… 2023 | 2024 | 2025 |

| < 670 | 230 | 225€ | 200 |

| 600 – 900 | 260 | 250 | 220 |

| 900 – 1166,7 | 275 | 267 | 260 |

| 1166,7 – 1300 | 291 | 291 | 291 |

| 1300 – 1500 | 294 | 294 | 294 |

| 1500 – 1700 | 294 | 294 | 294 |

| 1700 – 1850 | 310 | 320 | 350 |

| 1850 – 2030 | 315 | 325 | 370 |

| 2030 – 2330 | 320 | 330 | 390 |

| 2330 – 2760 | 330 | 340 | 415 |

| 2760 – 3190 | 350 | 360 | 440 |

| 3190 – 3620 | 370 | 380 | 465 |

| 3620 – 4050 | 390 | 400 | 490 |

| 4050 – 6000 | 420 | 445 | 530 |

| 6000+ | 500 | 530 | 590 |

Minimum contribution base

During 2023 the following groups of autonomo will not be eligible for a contribution base under 1000€.

- Family members of the self-employed who assist in the family business.

- Directors of limited companies.

- Sole traders registered in modality of indirect assessment of income ( Modulus system )

Projection of earnings.

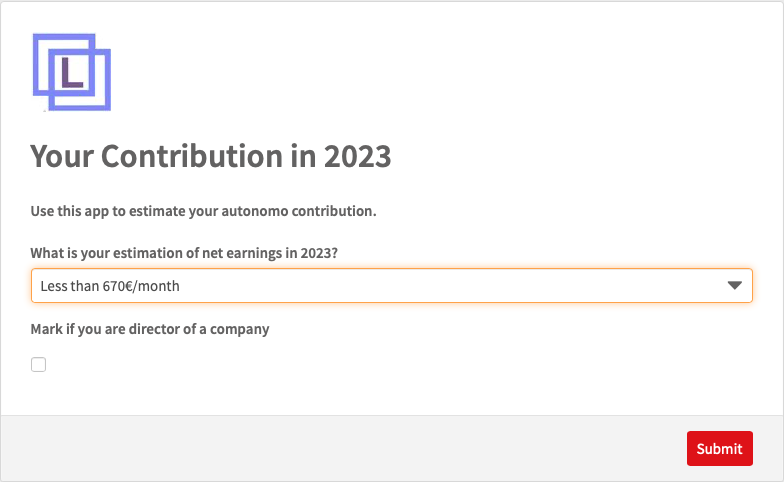

This new method requires that you make a projection of earning to set your contribution. Surely, this will need to be adjusted along the way. For that reason this new method allows up to 6 changes per year in your contribution base.

At the end of the year it will be the time to make the final adjustment.It will be a time to pay for the difference or request a refund.

Autonomos who register after January, 1st will have to report an estimation of earning for the year.

Those who are already registered in 2022 will continue into 2023 with the same base as they have in record. Unless they actually had the minimum base, 960,60€, which will turn into 1025,21€ in 2023.

This will correspond to an actual salary of 1300 – 1700€. If their incomes goes out of this range they will need report a different one. Be careful, if you leave it too low for your earnings, you will have an unpleasant surprise at the end of 2023 when the contribution is finally revised.

How do they know how much I earned during the year?

The social security has ways to know who much is the actual income of an autonomo. Reports made to tax office via Modelo 130 shows the balance of the business. Since the self-employed trades in his own name whatever the business net balance shows , that is his earnings.

Autonomos showing high net balance will do well to consider other legal forms, such as a company , where there’s distinction between what the business is earning and the salary of a director.

How the new contribution system affects new self-employed workers

Are you considering of becoming self-employed? There is no need to be afraid to start. The Government will continue to offer the Flat Rate of 80 euros for new Autonomos.

This benefit can last from 12 to 24 months, although it can be extended up to 36 months. This will depend on the Autonomous Region in which you are located and the net income obtained during the first year.

Limit Consulting

Limit Consulting